One of our newest clients called us in a panic recently. Apparently, one of his company's brand VPs is putting enormous pressure on him and his team to demonstrate where every single dollar they put into shopper marketing and e-commerce budget has been invested. Not only do they want high-level totals but also the granular details on sub-brand level, tactic by tactic, with shopper messaging and creative executions and coupon incentive details.

Today, I want to share a few thoughts on why these requests, while completely natural and innocent on the surface, drive shopper marketers crazy. I will also share some thoughts on how this dynamic is killing your team's productivity and spirit and explain what shopper marketing leaders can do about such requests.

Why Is Pressure For Shopper Marketing Accountability Rising?

These internal demands my clients experience are not new, but what is new is that these questions are coming with more intensity than ever. Shopper marketing, no longer a bright shiny object of the past decade, is today an established capability that is expected to deliver solid returns. Not only brands want to be assured that shopper marketing overall ROI is better than trade or national marketing programs, they expect constant communication from the customer-facing marketing teams. Brand managers want to control the brand message across the entire path to purchase, have stronger relationships with key retail partners and optimize their entire marketing mix on an on-going basis, not just once every year or two when they can afford the big MMA project.

Unfortunately, for many brand managers, shopper marketing remains a black hole. There are at least three reasons for this:

- Inherent organizational complexity: It's simply not possible to be in the loop on every single work stream within a large, multi-brand, geographically spread out matrix CPG organization where silos are rampant. This complexity comes with the territory, and there is little we can do about the organizational structure itself, other than staying aware of its shortcomings and silos and proactively becoming ultra-transparent.

- Lack of marketing systems and tools: Due to forever relying on retailers to deliver our products to consumers and letting them own customer relationships, most CPG marketers didn't grow up as data and technology geeks and never felt empowered to demand user-friendly technology to help them perform their jobs and automate marketing operations. Spreadsheets seemed to work until marketing channel proliferation literally exploded in the last decade.

- Old school, insanely messy and political funding processes: This is the topic I want to dive into today. It is a reason for much frustration, late nights at work, rampant confusion, pervasive distrust and enormous amounts of lost productivity.

How Complex is Shopper Marketing Funding, Really?

The un-initiated ones might think that managing marketing budgets is not rockets science. And to some extent I might agree: budget management is supposed to be a simple exercise in arithmetics that any intern could master. That was before marketing budgets gradually became more and more fragmented. This fragmentation was caused by several factors:

- Rising power of retail chains that demanded not only more trade funding (e.g. price incentives), but also funding for their shopper marketing efforts;

- Growth of digital and mobile technology that justified creation of a dedicated fund to test and learn;

- Popularization of store-back planning and shopper insights-driven solutions co-created with retail partners, often involving multiple complementary brands;

- Emergence of e-commerce as a fully fledged, well-staffed and well-funded capability.

Despite this fragmentation, or perhaps because of it, the lines between these marketing silos are blurring and the funding of shopper marketing programs is becoming more complex and confusing. Here is a hypothetical example all too common in our industry where shopper marketing activities can be funded from a variety of sources:

- Brand-specific funds determined by the brand teams to dedicate to customer-specific activations.

- Innovation support budgets, which are often different from the brand funds above. These are intended to ensure quicker sell-in and ACV coverage and are typically non annualized/renewed each year.

- Shopper marketing budgets, a larger pool of money, often created by levying a "tax" on each brand's P&L. These budgets are intended to fund bigger ideas, scale shopper solutions and elevate the conversations with retail partners.

- Trade funds that sales teams agree to convert into "non-price" shopper activations to achieve certain objectives, such as increasing item velocity before shelf review to avoid de-listing, for instance.

- Slotting fees that savvy sales and marketing teams convince retailers to re-invest in awareness and traffic building tactics for the new product launches.

- Consumer promotions funds that, in the age of geo-targeted media, look more and more like shopper marketing. In fact, many clients encourage their shopper teams to customize messaging for their national in-store media buys to drive more retailer relevance.

- E-commerce funds that are now merging with in-store activation budgets. This is due to "brick & click" retailers like Ahold & Peapod, Walmart & Walmart.com, Kroger & Kroger.com, Shoprite & Shoprite From Home expecting to have holistic, omnichannel JBP and activation.

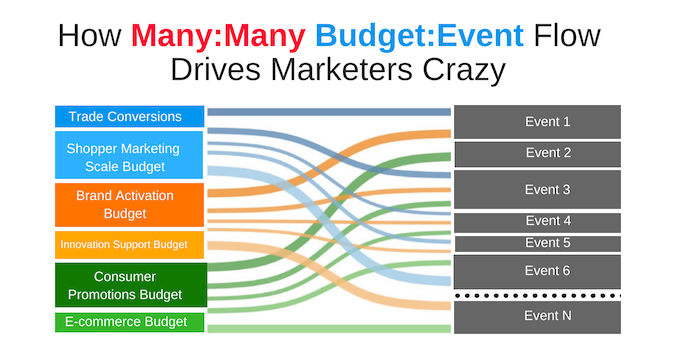

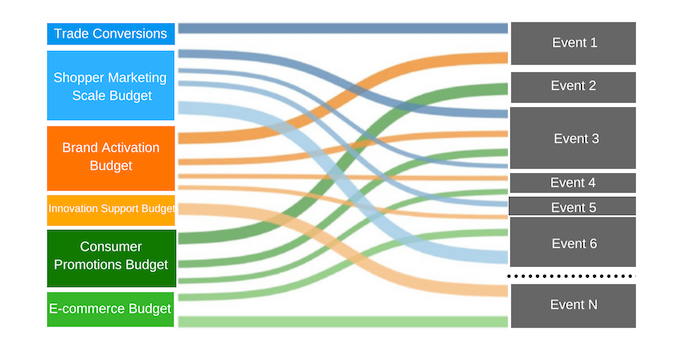

All these funds now float around and fund a variety of programs, from simple, single-band and single-tactic events to complex, scale programs with 360-degree messaging along the entire path to purchase. This results in many:many relationships between sources of funds (Budgets) and uses of funds (Events). Here is what a simplified many:many scenario could look like:

This chart is a Sankey diagram, a type of data visualization technique that is very fitting to illustrate our case here. On the left side, you see the typical budget sources that come from all over the place. The funds float to fund one or, in most cases, many events on the right side of the diagram. If you notice, each event may be funded from more than one budget source, too, hence many:many flow of funds that is so confusing and frustrating to manage.

The reality is, Sadly, Far more complex

The hypothetical example above is just a simplistic model to help you understand the principle of many:many relationships between budget and programs. The harsh wake-up call for marketing leaders comes when they attempt to document the number of individual budget buckets and events they fund. The actual numbers are often mind-blowing and reveal a sad reality: most of shopper marketers are glorified spreadsheet managers, with so much time spent on tracking sources and uses of funds, internal reporting and repackaging data for various stakeholders, that they don't have any time left for strategic, breakthrough work.

When this wake-up call is rung, clients come to us for help. They deploy Shopperations because they want to sort out their process, standardize nomenclature and create a transparent flow of funds that is easy to report on at any given moment without burning their teams out.

We work with large and medium-size enterprises who run multi-brand portfolios that are activated across multiple retail accounts. A typical mid-size CPG company has an average of 275 budgets that fund 500 programs.

Not only is the sheer number of funds and programs overwhelming - the "spending rules" for various budget types could be vastly different. Some are given on total business unit level and can be shared across multiple brands, others are brand- and even sub-brand-specific and can only be used to fund a specific product line. Some funds are explicitly given for coupon redemption only, others are only given for insertion and non-price activations, and a number are flexible and can be applied to either.

Does this come as a surprise to you? Do you know how complex your team's budgeting mechanism is?

So, now what?

If you feel this "many:many" problem is impacting your team's productivity and distracts them from doing strategically significant work, consider the following steps:

1. Document and measure complexity to determine the severity of the issue. Let us help you create a team-wide audit to study and capture exactly who funds your activities and what "rules" come with each budget stream. We will also measure the degree of confusion and frustration your team experiences and the toll it takes on their productivity and morale.

2. Challenge existing funding process. Our complex funding mechanisms are working against us. The smaller players who are eating our market share do not have the same burden of complexity and silos, as Peter Breen eloquently explained in his blog post. Resist micromanagement at the funding and planning stage and demand some space for your team to go after big wins with retail customers. This may mean pooling all brands resources to bigger budget level to activate strategic, multi-brand shopper platforms. This can get political really fast. The only way to make it happen is to generate strategic shopper and customer insights, determine "big bets" your team will focus on and get air cover from your SLT along. Your leadership, resolve and courage to say "no" to many anxious sponsors will also go a long way.

3. Commit to ultra-transparency and spend accountability and be open to input. To calm down sponsors and assure them that the funding will be spent on strategy, request that brands' strategy briefs are shared early and mandate your team to follow them relentlessly. In addition, share your plans with brands on an on-going basis and be open to input. It's important to distinguish "input" from "approval". The former is taken in and the final call to act upon it is still up to your team. Input does not slow your team down and doesn't rob them of the sense of ownership. "Approval" is the opposite of "input", it ruins the spirit of partnership and creates perception of risk for approval seekers.

4. Implement technology to automate minutiae. As I demonstrated above, the funding complexity in CPG marketing industry is no joke, and Excel is no longer cutting it. Real-time collaborative planning systems are long overdue in our industry, and it doesn't have to be a massive IT-led "enterprise transformation" initiative. Here is a case study example of how Shopperations helped Hormel shopper marketers create order out of chaos. Process automation is not a nice to have anymore. Having modern tools to enable your team to own their numbers and be confident and agile in their decision making is a tremendous competitive advantage.

5. Relentlessly measure and share results with your sponsors. Desire to measure marketing ROI is likely already on top of your mind. And rightfully so, because your sponsors deserve to know how your programs are helping drive their business. Engage them in the conversation on methodology, frequency and scope of your analytics efforts. Share often and err on the side of over-sharing. But watch out - you can't begin here until you address the steps above. Otherwise, you are running the risk of spending a lot of money on non-repeatable, non-actionable analytics that will rely on bad data and will further distract your already stressed out team. We wrote a blog post about this phenomenon that dives deeper into why so many marketers are not ready for analytics.

You may wonder if our client's story had a happy ending. It did. After taking a deep dive into Shopperations Report Engine, he felt relieved that all the hard work his team did during planning season didn't go to waste. The tactical plans are neatly recorded in a cloud-based environment where they are continuously updated as inevitable changes occur. He learned how to generate robust, custom reports and share with the Brand VP in just a few minutes, without sending his team on a fire drill mission.

OTHER POSTS YOU MAY LIKE:

Cart Before Horse: You Are Not Ready For Post-Event Analytics

How to Harness The Elusive Shopper Marketing KPIs

10 Rookie Shopper Marketer's Must-Dos